To become a successful trader, you need to have the right mindset. You cannot go by your emotions as it can lead to huge losses. A profitable trader takes the right call, understands the market trend, and makes decisions. The Wall Street cheat sheet is a living example of where various emotions come into play while trading in the stock. The one who has a proper mindset will ultimately emerge in getting profits. Hence, anger, fear, pride, happiness, and similar emotions are baseless while trading stocks and security.

Hence, you must first understand your emotional traits if you are an active trader in stocks and securities, which can lead to rash decisions that can hinder your success. Therefore, you must control your emotions while trading in stocks and securities. The ‘The’ factor differentiates between a profitable and non-profitable trader.

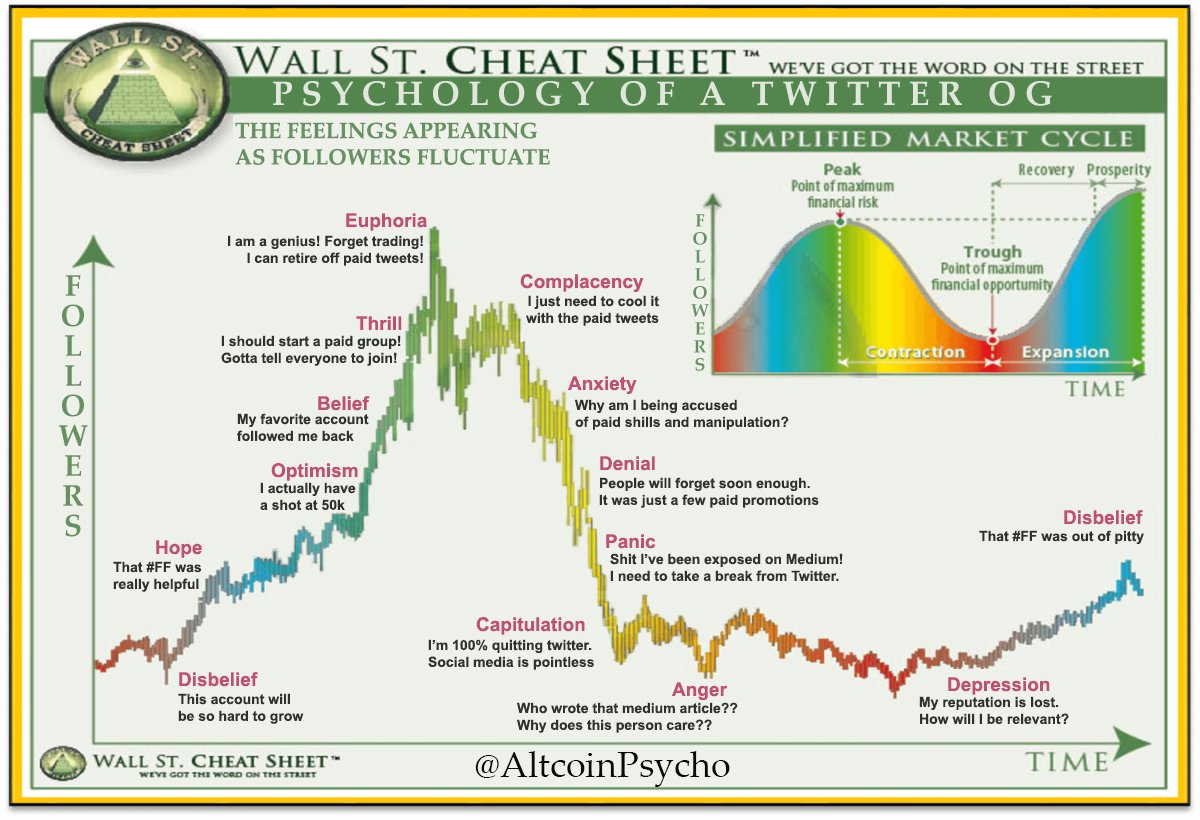

Image Source: AltcoinPsycho

Contents

10 Standard Wall Street Cheat Sheets

Following are 10 standard Wall Street cheat sheet explanation that gives a clear picture of the mindset of the people dealing during the time of trading in stocks.

1. Disbelief:

According to the Wall Street cheat sheet, disbelief plays a major psychological hiccup among the amateurs. Usually, when there is an increase in the prices of shares after a bear, amateurs tend to play safe and remain sidelined. During these times, you will find experienced participants in the market as they have a thorough knowledge of the market trend. Experience also plays a significant factor for the professional participants. On the other hand, the new participants will doubt the price rise. However, they try to come into play when the price rise trend starts growing. They will then regret challenging the price rise and try to keep a foot in the emerging trend in the later stages.

2. Hope:

Hope is an extremely dangerous emotion as it leads traders to huge losses. It gives the traders a sense of false confidence, thus making them land deep into losses. It ultimately makes them feel dejected when they do not win. You must depend on your trading psychology and hope to be a profitable trader. Hope is an evil emotion in trading because you will always think of winning. You are at risk if you keep thinking that things will take a turn shortly. Hence, you must develop a correct mindset while trading in shares. You must understand that markets are never constant. On certain days you will prosper, while on most days, you will fail to make any impact. Hence, in trading, you must set a target point, so you do not incur huge losses.

3. Greed:

One of the primary reasons for the downfall of a trader in the stock market is greed. According to the Wall Street cheat trading cheat sheet, desire can make a trader pauper. The game’s rules are that you must never trade with the hope of making a fortune in one day. Therefore, on a bright day, the moment you find your profit are beyond your expectation, pull out instantly. It is a significant problem with most traders as they will continue playing, hoping the price will reach its zenith. However, within seconds, there is a sudden crash, and with that, all your hopes are instantly shattered. Therefore, the best solution to combat greed is to set yourself a profit target.

On the other hand, you can also define your stop-loss during trading. It helps you not to incur a massive slump in losses as the moment the prices of the shares will start falling; you can still walk away with your initial investment.

4. Adaptive:

The market cannot give you the exact daily results and changes within seconds. However, remember that the Wall Street stock pattern cheat sheet is like a cycle, and it cannot continue to be in one position for an indefinite time. Hence, if you feel that the day does not belong to you, you should stay away from the market. The Wall Street stock market cheat sheet shows that if you are adaptive to the changing market trends, you will ultimately be on the safe side. It also protects your emotions to come into play which otherwise can be a decisive factor for your profits or losses in the share market. Since markets are unpredictable, it is advisable that unless you are sure about the trading of a particular day, do not trade. It is better to take the day off from the market so that you can relax and see the shortcomings.

5. Regret:

Regret is a psychological emotion that can lead to significant losses, especially while trading in market shares. Once you regret not placing a trade that was in a boom, it is definite that you will take the wrong step next without thinking. Hence, you must treat each trade as a separate transaction. It would be best if you also had control of your emotions while trading in market shares. Therefore, you must have a mindset to accept the fact opportunities come and go. In every transaction, there is a win and a loss. Hence, once you adapt to the rule, nothing will stop you from becoming a profitable trader.

See Also: Stock Market Trading Patterns Cheat Sheet

6. Belief and thrill:

You mustn’t enter the market because it is all over the news. It is like a trap where you fear missing out on an opportunity. During such a boom period, more and more buyers will join like bees to have a share of the profit. It seems to the traders that it is a lifetime opportunity for them, so they will start referring the same to their friends and family members. You must, however, hold your breath and not jump into trading instantly. Therefore, you should understand the market trend and be aware of the shortcomings. It will do good for your investment.

7. Euphoria:

Euphoria is one of the most psychological errors that users make, according to Wall Street cheat trading cheat sheet. During this time, when prices of the shares and stocks will be soaring to new heights, it will attract more and more buyers. However, there is a word of caution for the buyers. The term says that no matter how high the prices will soar, there will always be a buyer to buy the shares at that price.

8. Complacency:

According to the fluctuations in the market trend, there is also a change in the Wall street market patterns cheat sheet. During this phase, the momentum in the market comes to a sudden halt, and it then takes a reversal turn. During these times, traders make a huge mistake by waiting for the market trend to continue. Hence, in the process, they also tend to hold on to the shares hoping that the current situation is temporary. Here, the traders fail to identify the market trend and trade with the help of their emotions. They fail to understand that the market has reached a point where there will be a reversal, ultimately leading to huge losses. Hence, it is advisable that when you face such a situation of a temporary stop in the momentum of the market, immediately pull yourself out of the market.

9. Anxiety and Denial:

One prime Wall Street cheat sheet for day trading is anxiety and denial. There is no doubt there are ups and downs in market trading. However, if you want to see yourself as a profitable trader, you should control your anxiety and depression. It can lead to you making the wrong decision at the wrong time. One of the primary reasons for anxiety and denial is failure to recognize your self-trust. You must try and build your confidence level if you want to become a successful trader. You must understand that you are real money and what you see on the screen is your money. Hence, it would be best to trade safely while dealing with market trading and not let emotions cloud your decisions.

10. Panic, Anger, and Depression:

A time must come during market trading when you will see the prices of the shares declining faster. It is during these moments that you have to have complete control over your emotions. Panic, anger, and depression will seize your mind and lead to a wrong decision. You must understand that the market trends are like the wheels of a cycle, and they will return to their form. Hence, it would be best to be patient and calm during these abnormal situations. A wrong step can ruin your life.

See Also: Common Types Of Candlesticks and Their Meaning

Conclusion

You must understand the trading emotions; however, implementing them in real-time is daunting. Hence, you must train yourself to control your emotions during difficult times and when you are on a winning spree. Therefore, you must familiarize yourself to be more disciplined while dealing with shares and securities. One of the best ways is to read about the emerging market trends and how they function in the real world. You can also take some valuable tips from people who are already a veteran in the business, which will benefit you exceptionally shortly.

Post You May Like:

- Start Day Trading With $100

- Calculate Equity Dilution for Startups

- Penny Stocks on Cash App Under $5