The world of stock trading can seem bewildering to many, especially those just starting their investment journey. Among the many tools at the disposal of a trader or investor, one of the most essential and effective is the candlestick chart. Developed by Homma Munehisa, the rice trader from Sakata, in the 18th century, these charts represent price movements in a given period. Candlestick patterns are crucial in predicting market trends and aiding investment decisions. Keep reading to uncover the method behind these patterns, interpretation techniques, and how they can aid your investment strategy.

Contents

Introduction to Candlestick Charts

A candlestick chart tracks an investment instrument’s opening, high, low, and closing price over a period. These four points create a ‘candle’ indicating whether the prices increased or decreased during that time. The body of the candle refers to the area between the opening and closing price, while the lines above and below, known as the wicks or shadows, represent the high and low prices. By understanding these candles’ assorted shapes and grouping patterns, you can learn a great deal about the market sentiment.

For someone new to the field, learning how to read and interpret these charts is crucial. Misinterpretation can lead to improper decision-making and potential investment losses. It’s not about predicting the future but identifying potential opportunities and trends based on historical data.

While these techniques might seem intimidating initially, you can become proficient with added practice and understanding. Doing so will dramatically improve the quality of your trading decisions, helping you avoid potential pitfalls and capitalize on profitable opportunities. Once you familiarize yourself with interpreting these patterns, your confidence and skill in trading will undoubtedly grow.

Basics of Candlestick Patterns

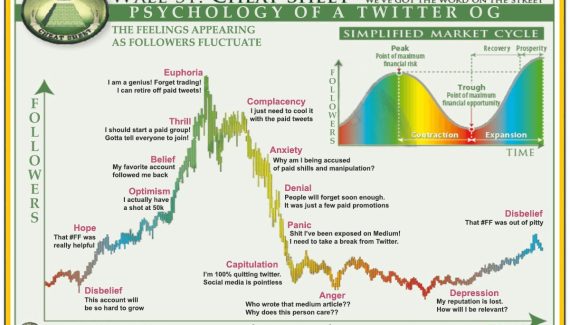

The concept of candlestick patterns is fundamental to understanding market psychology. These patterns represent the collective buying and selling decisions of all market participants. When a specific pattern repeats itself continually, it often suggests that traders are reacting to the same types of market signals, thus forming an identifiable trend. Observing such patterns can offer valuable insights into the market’s direction.

Identifying these recurring trends and patterns early is key to successful trading. It allows traders to predict potential price movements, enabling them to enter or exit trades profitably. The most common candlestick patterns include bullish and bearish engulfing patterns, the hammer, the shooting star, and the doji.

Each candlestick pattern conveys a different market sentiment and outlook, and the stronger the pattern, the more likely it is to predict future price behavior. By understanding these patterns, traders can gain an edge by anticipating possible price moves before they happen, allowing for effective strategizing and the potential for increased profits.

Benefits of Understanding Candlestick Patterns

Getting to grips with candlestick patterns offers far-reaching benefits to traders. The most obvious is the ability to interpret market trends and price movements accurately. This ability to analyze the market is fundamental to making informed trading decisions. Rather than trading on gut feelings or hunches, understanding these patterns allows for data-driven trading.

Moreover, mastering candlestick patterns improves decision-making speed. Speed is critical in trading, particularly for those engaging in high-frequency or day trading. Therefore, understanding these patterns enables traders to enter or exit quickly, maximizing potential profits and minimizing losses.

Another substantial benefit is risk identification. Reinforced by other technical indicators, these patterns can issue warnings about potential price reversals or continuations. Traders can then adjust their strategies to minimize the risk of losses and take advantage of potential opportunities.

Mastering candlestick patterns is a skill that takes time and practice, but the rewards can be substantial. Keep taking steps towards understanding this crucial trading tool thoroughly and incorporate it as part of a comprehensive and successful trading strategy.