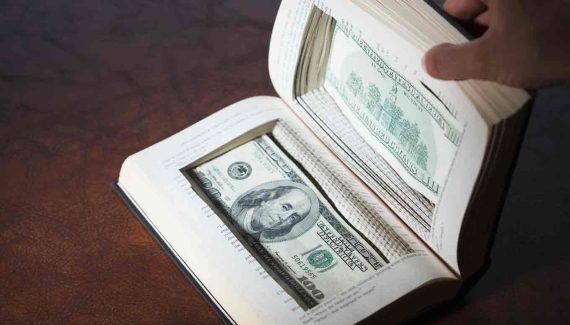

Buying a home is one of the biggest and most expensive investments of your life. Whether you’re buying an investment property, a primary residence, or a vacation home, the process involves a lot of research, negotiation, and paperwork. Buying a house can be a difficult and expensive process. Most people don’t have enough money to buy a house outright, and even those who can often find themselves frustrated by the process. Luckily, there are ways to buy a house without money. You can find properties that are fixer-uppers, which have been renovated but need more work, and use fixer-upper investing to turn a profit without having to invest your own money.

We know that buying a house is an expensive and often stressful endeavor. If you don’t have enough money for a down payment, don’t fret! There are many ways to buy a house without putting down a single dollar. This article will discuss some of the lesser-known ways to acquire a home.

Contents

Why Buy a Fixer-Upper House?

You can buy a house that needs minor repairs and renovations, also known as a fixer-upper. There are thousands of fixer-upper homes for sale in the United States, and they make great sources of income when you purchase them with the intention of reselling them for a profit. This process requires a lot of hard work and research, but it can be extremely rewarding when you find a property that’s in good condition but needs just a little work to make it great. You can also use fixer-upper investing to turn a profit without having to invest your own money.

By investing in fixer-uppers, you can turn a profit without having to put any money down. You can also use fixer-upper investing to buy existing homes, which have been renovated but need more work and turn those into profitable investments without having to invest your own money.

8 Ways to Buy a Fixer-Upper House With No Money

Home renovation loans:

One of the best ways to buy a house without a lot of money is to use home renovation loans to buy fixer-upper houses. During the renovation process, you can make a lot of money by investing in a home before it is finished. The renovation process is a great way to get started as a fixer-upper investor and can help you acquire a profitable real estate investment property without having to put any of your money down. You can use your renovation profits to make further renovations on the property and eventually sell it to earn a big profit.

Seller financing:

Another option to buy a fixer-upper house is seller financing. In this case, you will be needed to sign a mortgage with the seller. Here, the loan amount is fixed by the seller itself. There is no fixed amount set, it is done as per the seller. This can be a good option if you want to buy a house without money. One advantage of seller financing is that you can set up installments at your convenience. It can be weekly, monthly or yearly installments.

Investors buy your home with cash:

Here, investors buy your home and help to clear the debts. These investors aim at buying the property and later selling the same at higher prices. They do not worry about the maintenance or condition of your home. This is done when owners want to sell their house immediately. This is a better option because you can sell your house to the investors and later reuse the money for your fixer-upper house. The only disadvantage here is that it can be challenging to find these investors who are willing to buy your house at the quoted price. However, real estate agents can help you find some great deals in such situations.

Renting:

Renting can be a great option for you when your credit score is too low. You can rent to own a fixer-upper in almost any neighborhood. No matter where you are, you can get a house at affordable rates. Since you can own your own home for a fixed amount of time, you only pay for what you use. In the rent-to-own agreement you usually have to pay the seller only once and this is known as the option fee. Therefore, if you don’t have the money, you can try this option.

Partner up:

option to consider if you don’t have money to buy a fixer-upper house is to partner up. You can try and reach out to people who know how to buy a fixer-upper house and partner with them. But make sure to sign up a written agreement before you get a house. You want to make sure everything is legal and you don’t face any trouble in the future. Also, ensure that there is someone to offer surety for your agreement.

Hard Money Lenders:

If you have the money to invest, you can find hard money lenders who will let you use your home as collateral to borrow money to make more renovations on the property and eventually buy it. This is a great way to invest in fixer-upper properties without having to put any of your own money down. You can use these profits to make further renovations on the property and eventually sell it to earn a big profit. It can take a long time to find the right hard money lender, but the payoff can be well worth it.

Private Money Lenders:

Private money lenders are preparing to buy up some of the country’s most distressed fixer-upper houses in an attempt to resuscitate the sector and offer a new source of income for first-time buyers. The firms, which typically lend to wealthy individuals and institutional investors, are partnering with real estate investors, who purchase houses that have fallen into disrepair and fix them up before selling them on. The partnerships are an attempt by the private money lenders to expand their asset base.

Bridge loans:

The bridge loans will enable the private money lenders to buy up the fixer-upper houses, which have been hit hard by the central bank’s tightening of credit. The bridge loans are typically unsecured loans, provided to borrowers that have strong enough assets to collateralize the loan but need additional liquidity to purchase a fixer-upper house. The bridge loans provide the borrowers with enough liquidity to purchase the fixer-upper house. The partnership between the private money lenders and the real estate investors is expected to increase the number of fixer-upper houses on the market, which will provide a new source of income for first-time buyers.

Conclusion

Buying a fixer-upper house is a smart investment strategy for anyone who wants to increase their home equity and build equity in their property. Not only will you increase your home’s value, but you’ll also be building equity in your property which will help you if you ever need to sell. While fixing up a home is hard work, it’s also rewarding, especially if you find a house that has great bones and a lot of potential. Just make sure to do your research, find a good contractor, and get financing before you go all-in.

Buying a fixer-upper house is a great way to build wealth and experience the American dream. However, it requires a lot of upfront work, and it can be challenging to find qualified sellers. In this article, we have provided solutions for overcoming them. We have provided you with some of the most practical ideas to buy a fixer-upper house without spending money.

Posts You May Like:

- 12 Benefits of Mortgage Broker

- A Neo Bank and Succeed

- Get Personal Loans from Licensed Money Lenders